BEQUESTS AND LEGACIES

Would you like to receive SwissABILITY’s brochure on Bequests & Legacies ?

Our free guide explains everything you need to consider when writing a will and provides practical guidance on how to proceed. You can download it below or request a printed copy at info@swiss-ability.org.

FREQUENTLY ASKED QUESTIONS

Is it necessary to go to a public notary to draft a will?

It is not mandatory. The need for a notary public depends on the type of will you choose. For example, a holographic will can be written by anyone capable of doing so independently. However, if you prefer or require a public will, you will need to contact a public notary.

What is important to include in a holographic will?

For a holographic will to be valid in Switzerland, it must meet some basic requirements:

- Drafting entirely by hand: The will must be handwritten by the testator, without the use of typewriters or computers.

- Date: Must include the complete date (day, month and year) on which it is written.

- Signature: Must be signed by the testator, preferably at the end of the document, with first and last name.

- Clear Expression of Will: Must indicate clearly the provisions of the testator regarding the division of the estate or other wishes related to the succession.

- Legal capacity: The testator must be of legal age and in full capacity at the time of writing.

- Consistency: The content must not violate the legal minimum shares reserved for the heirs-at-law, as stipulated in Swiss inheritance law.

Here you can find an example of a holographic will (in Italian).

What happens if a will is not drawn up?

If no will is drawn up or a contract of inheritance concluded, the law will determine who inherits the estate and to what extent. In the absence of legitimate heirs, the property will be turned over to the state.

How can you draft a will if you are no longer able to write it by hand?

In this case, he may choose to make a public will, drawn up by a notary public. It will be necessary to sign it in the presence of two witnesses, who will attest that the document expresses his last wishes.

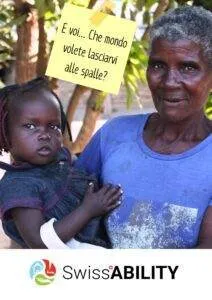

How important are bequests and legacies to SwissABILITY?

For SwissABILITY, donations and bequests play a vital role. Making a bequest or naming SwissABILITY as an heir makes it possible to carry out concrete projects, giving children, women and men with disabilities the opportunity to walk again and embark on a better life.

Is inheritance tax deducted from my bequest or estate to SwissABILITY?

No, SwissABILITY is a recognized charitable organization and, as such, is exempt from inheritance tax. Your donations and bequest will flow directly into our projects.